Introduction: Kenya’s Gypsum Market Potential

Kenya, strategically located in East Africa, is experiencing rapid economic growth and urbanization. The country’s construction sector is booming, with the government investing heavily in infrastructure development. This has created a significant demand for building materials, including gypsum, which is essential for cement production and gypsum board manufacturing. With Kenya’s urbanization rate projected to reach 40% by 2030 and 60% by 2050, the demand for gypsum-based products is expected to surge, making investments in gypsum crusher projects highly attractive.

Kenya’s Construction Boom and Gypsum Demand

Kenya serves as an economic hub for East Africa, with a rapidly growing construction sector. The Kenyan government has pledged to invest $40 billion in infrastructure projects over the next five years, encompassing roads, bridges, ports, schools, hospitals, and commercial buildings. The construction industry has consistently achieved an 8% annual growth rate over the past five years.

Gypsum is a critical raw material for:

- Cement production: Gypsum is used as a retarder to control the setting time of cement.

- Gypsum boards and plaster: Essential for interior construction and finishing.

- Agricultural applications: Gypsum improves soil structure and nutrient availability.

Despite the growing demand, Kenya’s domestic gypsum processing capacity is limited. This gap between supply and demand presents a significant opportunity for investors in gypsum crushing and processing projects.

Why Invest in a Gypsum Crusher Project in Kenya?

Investing in a gypsum crusher project in Kenya offers several compelling advantages:

- High ROI Potential: The calculation for Return on Investment (ROI) is straightforward:

ROI = (Net Profit / Total Investment) × 100%. Given the high demand for gypsum products, well-managed crusher projects can achieve attractive returns. - Growing Market: With the construction boom showing no signs of abating, demand for crushed and processed gypsum is expected to grow steadily.

- Government Incentives: The Kenyan government encourages investments in mining and processing equipment through various incentives.

- Export Opportunities: Kenya’s membership in the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA) allows for tariff-free access to a vast regional market, enhancing the potential customer base for gypsum products.

- Limited Local Competition: The local manufacturing sector for machinery and building materials is still developing, which means less local competition and greater opportunities for foreign investors.

Key Considerations for Gypsum Crusher Investment

Market Feasibility

Before investing, conduct a thorough market analysis to understand demand dynamics, customer needs, and the competitive landscape. Identify target customers, such as cement plants, construction material suppliers, and agricultural cooperatives.

Technical Feasibility

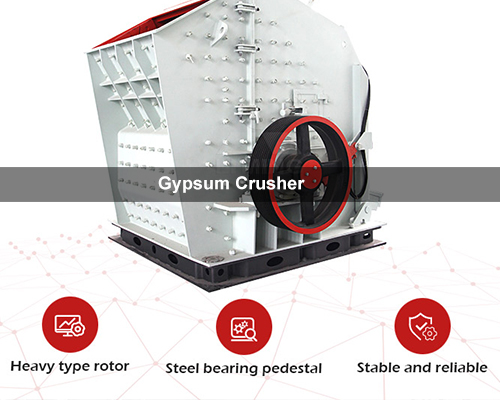

Select appropriate crushing technology based on the characteristics of Kenyan gypsum deposits. Key equipment includes:

- Jaw Crusher: For primary crushing (e.g., Liming’s C6X Series Jaw Crusher).

- Cone Crusher: For secondary crushing (e.g., Liming’s HST or HPT Series Cone Crusher).

- Impact Crusher: For finer crushing (e.g., Liming’s CI5X Series Impact Crusher).

- Grinding Mills: For pulverizing gypsum into powder (e.g., Liming’s LM Vertical Grinding Mills).

Ensure the chosen technology is robust, energy-efficient, and suitable for local conditions.

Financial Feasibility

Develop a detailed financial model including:

- Investment Costs: Land, machinery, installation, licensing.

- Operational Costs: Labor, energy, maintenance, transportation.

- Revenue Projections: Based on market prices and production capacity.

- Profitability Analysis: Calculate key indicators like Net Present Value (NPV), Internal Rate of Return (IRR), and payback period.

| Financial Metric | Description | Target Benchmark |

|---|---|---|

| ROI | Return on Investment | >20% annually |

| Payback Period | Time to recover initial investment | 3-5 years |

| NPV | Net Present Value | Positive (project-specific) |

| IRR | Internal Rate of Return | Exceeds cost of capital |

Legal and Regulatory Framework

Understand Kenya’s legal requirements for mining and processing operations, including:

- Mining licenses and permits from the Ministry of Mining.

- Environmental Impact Assessment (EIA) approvals from the National Environment Management Authority (NEMA).

- Compliance with health, safety, and labor regulations.

- Tax obligations and incentives.

Risk Analysis and Mitigation Strategies

Investing in Kenya, like any emerging market, involves certain risks. However, these can be effectively managed with careful planning.

| Risk Category | Potential Challenges | Mitigation Strategies |

|---|---|---|

| Political and Regulatory | Policy changes, bureaucratic delays, corruption | Engage local legal experts; build relationships with authorities; obtain all documentation; leverage bilateral investment treaties between China and Kenya |

| Economic | Currency fluctuations (Kenyan shilling), inflation, high financing costs | Hedge currency exposure; price contracts in stable currencies; explore local financing options; control costs |

| Operational | Equipment breakdown, supply chain disruptions, skilled labor shortage | Invest in reliable equipment (e.g., Liming crushers); maintain inventory spares; provide comprehensive training; implement preventive maintenance plans |

| Security | Theft, vandalism, occasional social unrest | Invest in site security; engage with local communities; obtain comprehensive insurance; monitor travel advisories |

Case Study: Projected ROI for a Medium-Scale Gypsum Crusher Plant

Consider a hypothetical investment in a medium-scale gypsum crusher plant in Kenya:

- Initial Investment: $1.5 million (including land, a Liming C6X Jaw Crusher, an HST Cone Crusher, conveying systems, installation, and initial operational capital)

- Annual Production Capacity: 50,000 tons of crushed gypsum

- Operating Costs: $250,000 per year (labor, energy, maintenance, etc.)

- Revenue: $50 per ton (market price)

- Annual Revenue: 50,000 tons × $50/ton = $2.5 million

- Annual Net Profit: $2.5 million – $250,000 = $2.25 million (before taxes and financing costs)

- ROI Calculation: ($2.25 million / $1.5 million) × 100% = 150%

This simplified example illustrates the high return potential. Actual figures will vary based on operational efficiency, market prices, and management effectiveness.

Strategies for Investment Success

- Partner with Local Experts: Collaborate with local businesses or consultants who understand the Kenyan market, regulatory environment, and cultural nuances.

- Attend Industry Events: Participate in trade shows like the Kenya International Industrial Expo or MINEXPO KENYA to network, understand the market, and showcase technology.

- Leverage Support from Chinese Institutions: Utilize resources and support from the Chinese Embassy in Kenya and organizations like the China Chamber of Commerce.

- Invest in Community Relations: Build positive relationships with local communities through employment and corporate social responsibility (CSR) initiatives, which can facilitate smoother operations.

- Focus on Efficiency and Maintenance: Choose reliable equipment known for low maintenance costs and high availability to maximize uptime and profitability. Liming Heavy Industry’s crushers, for example, are designed for durability and efficiency.

Conclusion: A Promising Investment Destination

Kenya’s construction boom, strategic location, and supportive investment climate make it a highly attractive destination for investments in gypsum crusher projects. While risks exist, they can be mitigated through careful planning, local partnerships, and choosing reliable equipment.

The significant and growing demand for gypsum products, coupled with the potential for high returns on investment, presents a compelling opportunity for investors and mining equipment manufacturers. By conducting thorough due diligence, leveraging available resources, and implementing effective operational strategies, investing in a gypsum crusher project in Kenya can be a highly profitable venture.

For those considering such an investment, now is an opportune time to enter the market and capitalize on Kenya’s growth trajectory.